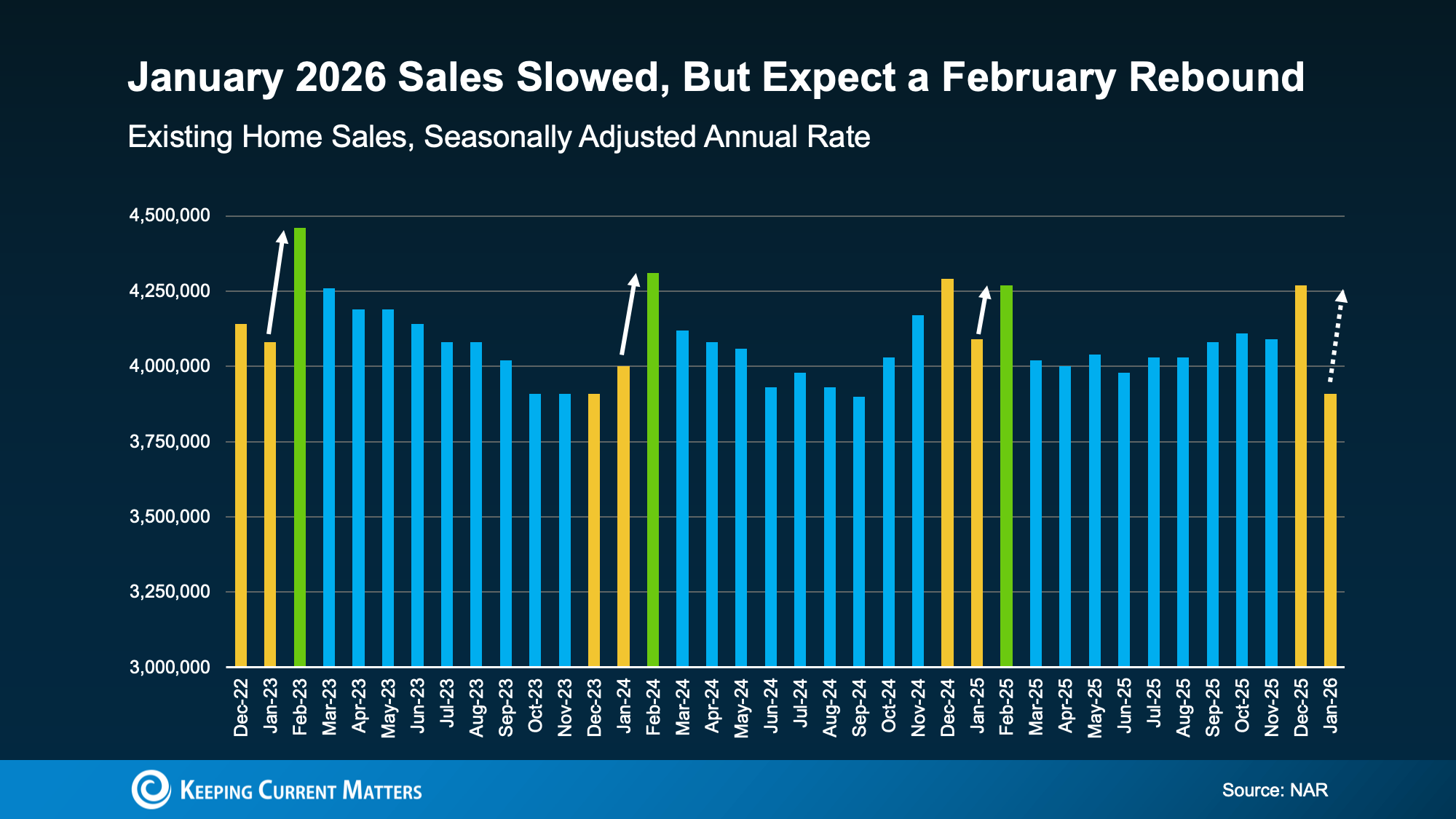

If you saw headlines that talked about how “home sales fell sharply in January,” it probably raised an eyebrow – especially if you’re thinking about selling your house. But context matters.

Yes, in January, home sales declined. But that has more to do with seasonality and the weather than it does with any big drop off in demand.

What’s Really Behind the Decline?

Reports coming out of the National Association of Realtors (NAR) say the pace of home sales fell roughly 8.4% last month compared to the month before. And that’s true. But it isn’t necessarily cause for alarm.

Data show it’s normal for sales to dip in January. In the last 4 years, that pattern has held true all but once. And sure, the decline we saw this year was a steeper drop off than the norm (the yellow bars on the right), but that can be explained too. More on that in a moment.

The really important part you’re not going to get from the headlines is this: typically speaking, the pace of home sales picks back up in February as the spring market starts to take off. That’s shown in the green bars below.

So even though the market slowed a bit momentarily, it should start to pick back up.

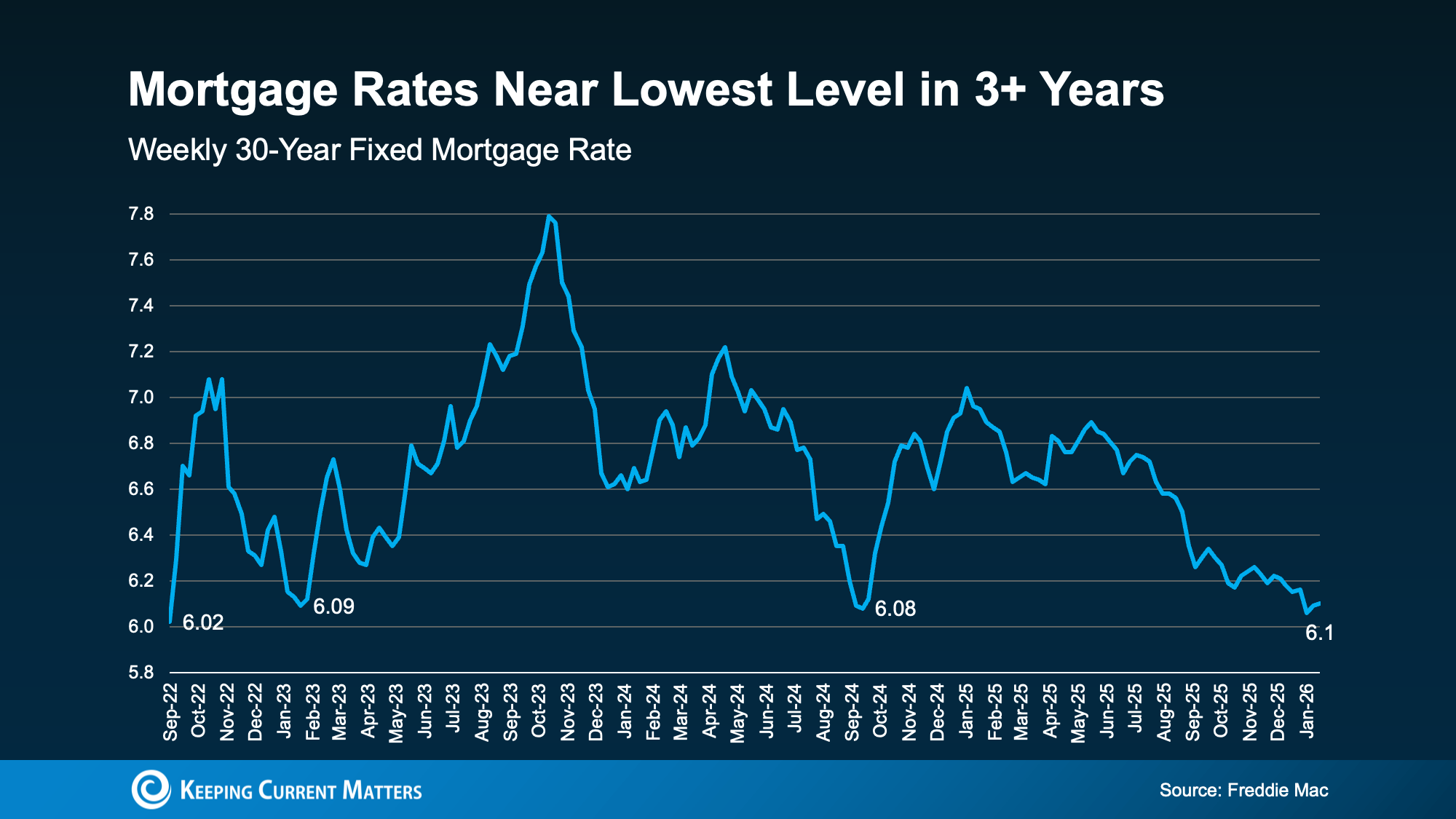

And just in case you’re wondering, why the bigger drop this year, especially with mortgage rates being lower than last year? Here’s your answer. As Realtor.com explains:

“Winter storm Fern, which dumped snow and ice across large swaths of the country, likely disrupted some closings, weighing on the data and making it difficult to pick out the housing market momentum trend from the weather noise.”

This January, 40 states were hit with widespread winter weather according to the National Weather Service. And in real estate, that slows down the momentum. Here’s why.

Existing home sales data tracks closed transactions, not new contracts. So, if inspections, appraisals, or final walk-throughs get delayed by storms, those deals often slide into the next month instead of falling apart – especially when buyers and sellers are still trying to move forward.

Will Home Sales Pick Back Up?

January’s missing sales are more likely “postponed” than “lost.” They haven’t disappeared. They’re just taking a little longer to close.

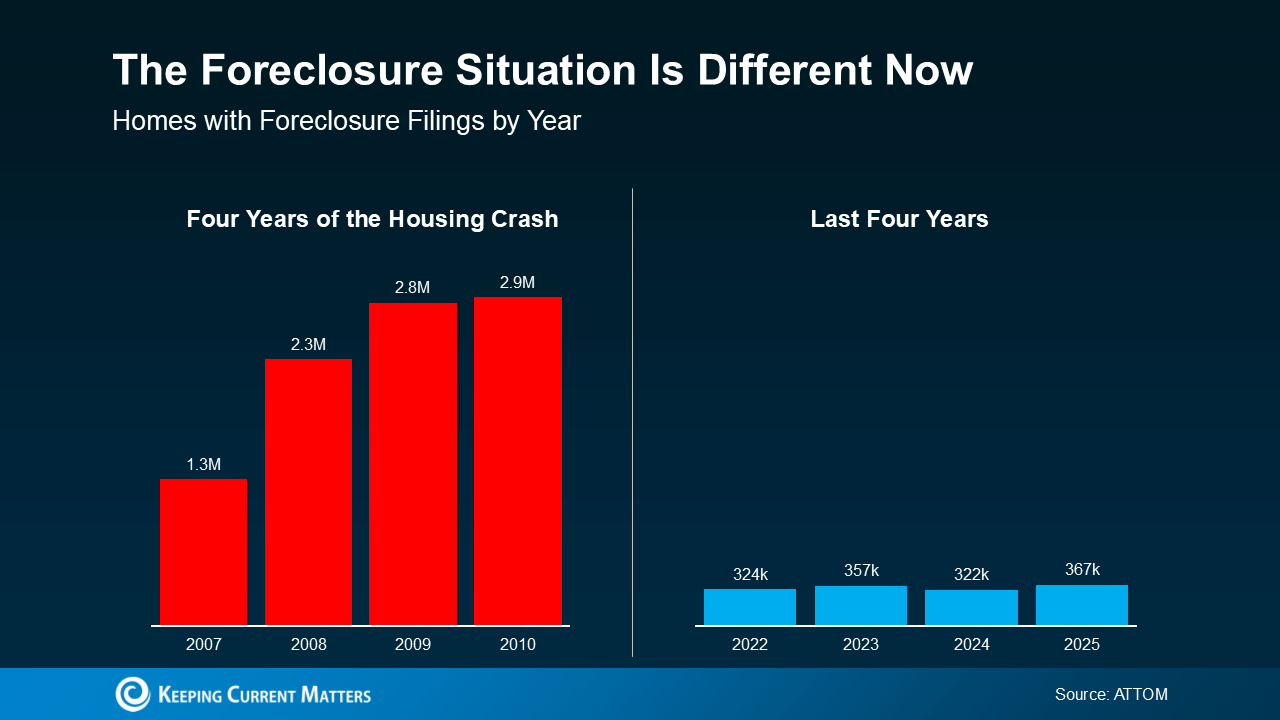

The rest of the data still points to a market that has traction heading into spring.

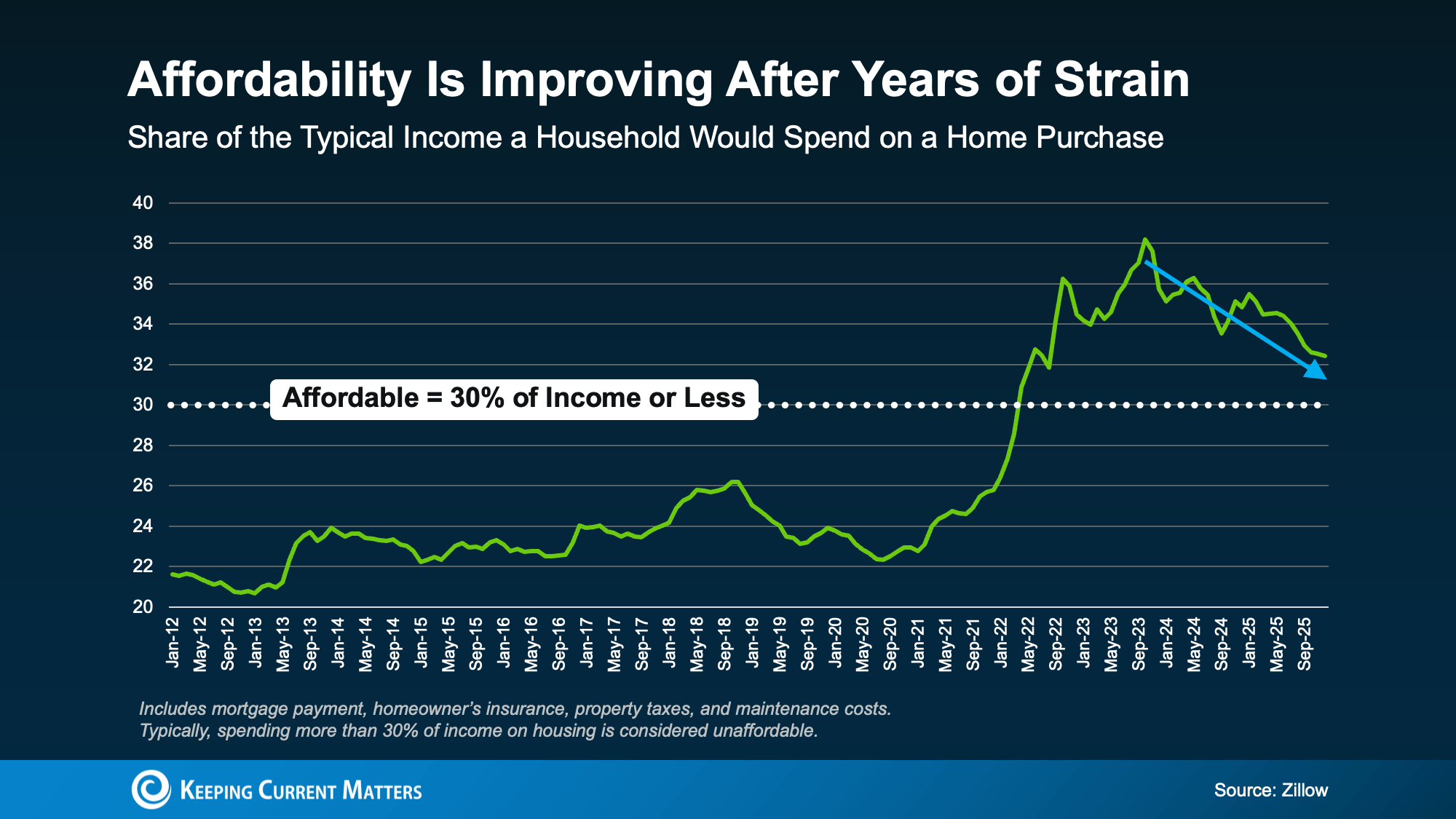

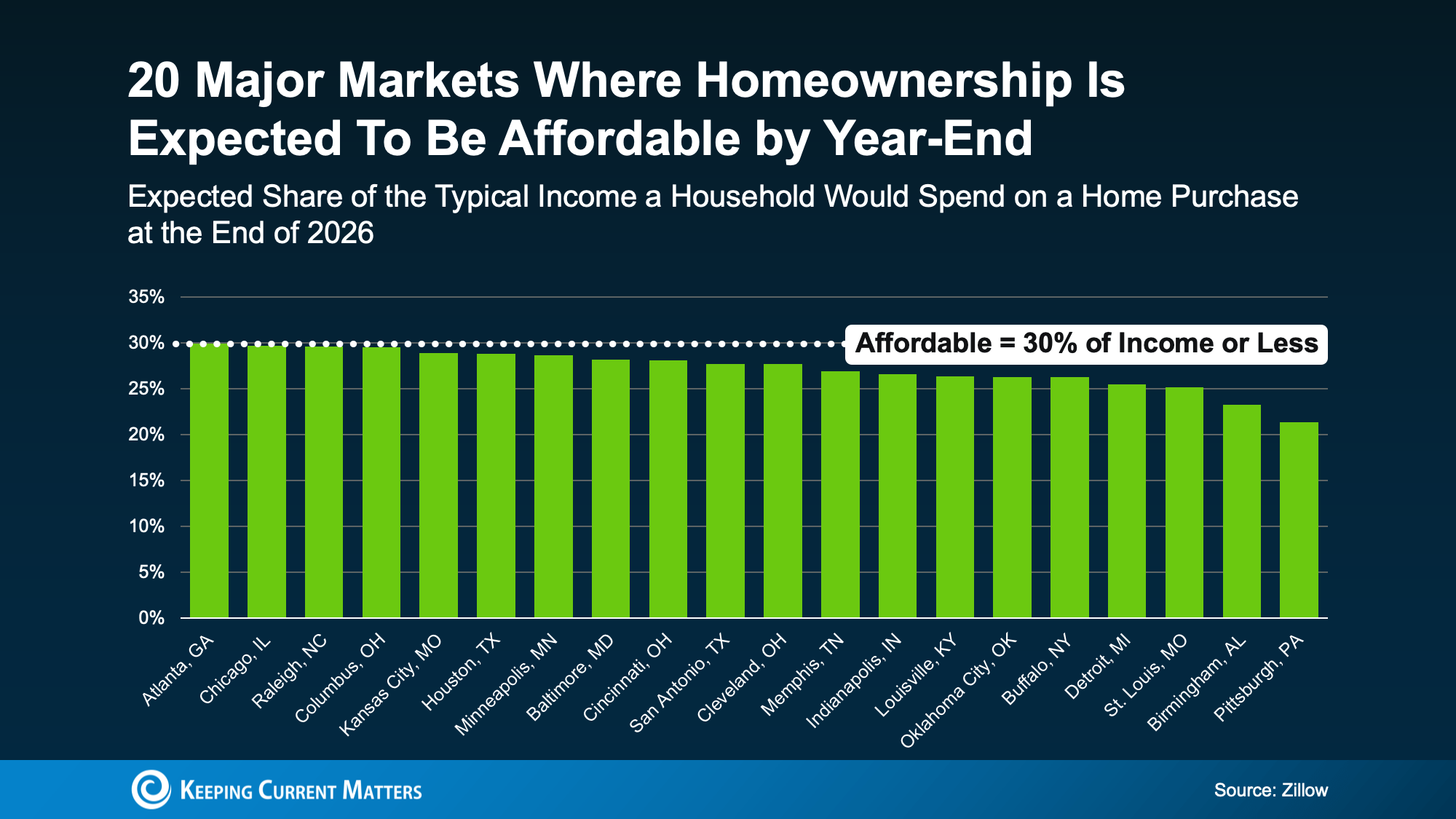

Affordability has improved for the 7th month in a row, and buyers are regaining negotiating power in many markets throughout the nation. So, this one monthly report doesn’t mean buyers aren’t buying. It just means, as weather warms up, activity should too.

Bottom Line

Don’t confuse a weather-impacted month with a market losing steam. If anything, improving affordability is an indicator of more activity to come, not less.

If you have questions about what you’re hearing online or in the news, reach out to a local real estate agent. Because the truth is, a little context can give you back your peace of mind.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link